The true cost of delayed supplier payments

The press has mentioned much about the trend for large organisations to extend suppliers’ payment terms. In recent times we have seen many high-profile organisations in the press for this practice. We were curious to find out if this approach really pays off, so we did the maths…

On the one hand, extending payment terms is understandable. It represents a flexible source of credit, reflective of the value of business with a supplier. It is also potentially a low-cost source of credit as suppliers tend not to charge interest on the amount outstanding for fear of damaging the relationship (often despite contractual or even regulatory/legal rights to do so).

The unilateral move of organisations towards delaying payments often gives the supplier little choice, especially given the balance of power in the relationship. It also ignores that the supplier’s pricing results from an earlier negotiation and agreement of payment terms.

The value of being a customer of choice

Our fourteen years of global supplier relationship management (SRM) research across over 1,200 organisations has shown organisations that are good at SRM achieve on average 4 to 6% annual post-contractual benefit (that is 4 to 6% over the agreed contractual terms) from their strategic suppliers. And if they are considered a customer of choice [1] by these suppliers they are twice as likely to receive other benefits such as access to the supplier’s A team, access to scarce resources in times of need and preferential pricing. They are also four times as likely to receive access to new innovation.

Our research over the years has found that there are three main reasons why suppliers regard an organisation as a customer of choice:

- Money – either it is a large source of revenue or profit

- Brand – or organisational alignment

- Behavioural aspects – i.e. whether you are easy to work with, whether you listen and whether they feel valued

By unilaterally changing payment terms we are affecting at least two of the attributes that give you a customer of choice advantage. But let’s look closer at the money aspect.

As an employee, it is often said that money is not a motivator, but if you get it wrong it can be a big de-motivator. Frederick Herzberg [2] said money is a 'hygiene' need and true motivators are more intrinsic like:

- Achievement

- Being listened to

- Recognition

- Type or quality of work

- Responsibility/trust

Why should it be any different for suppliers’? We ask them (often contractually) to do a good job and promise to pay them for doing it. They expect to get paid, just as you would expect to get paid as an employee. So by delaying payments or shifting terms, it is de-motivating suppliers, which will directly affect your organisation’s status as a customer of choice and the benefits and advantages this could potentially provide.

All industry insights in one E-Book

Download the SRM Research Report 2022 and get access to data points from over 300 companies (anonymously), 9 Case Studies and many more articles.

The financial benefit of delayed payment

To demonstrate the financial benefits of extending payment terms, let’s take the example of Jackson Steinem & Co., a fictional organisation paying its supplier £1.2 million per annum. For ease of our example, Jackson Steinem & Co.’s supplier payments are broken into 12 monthly payments of £100,000 each. The payment terms are 30 days and Jackson Steinem & Co.’s cost of capital is 5%.

Jackson Steinem & Co. decide to change their supplier payment terms from 30 to 60 days – and despite their £1.2m annual spend with the supplier, they save only £417.

For those interested, here’s the maths:

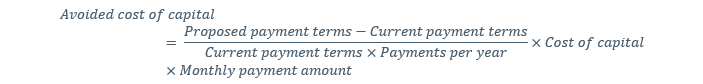

The formula to calculate the savings from delaying payment is as follows:

Jackson Steinem & Co. avoids the cost of capital for 30 days, which results in a saving of (((60 days minus 30 days = 30 days) divided by (30 days x 12 payments per year)) times the cost of capital, 5%) times the monthly amount, £100,000 = £417.

Or for the more mathematical of you: (((60-30)/(30x12)*0.05)*£100,000) = £417.

Remember the saving is on the cost of capital for the payment.

A common mistake is thinking that extending payment terms produces a saving of 5% of £100,000 (i.e. £5,000) because you are changing the payment terms which affect each month’s payment. Like Jackson Steinem & Co., the large majority of organisational spending is not one-off but regular ongoing monthly payments over the life of the contract (typically years).

In this case, Jackson Steinem & Co, hasn’t changed the frequency of the payments, nor the amount owed. They are still paid monthly, however, there is one month when a payment is delayed, but it still must be paid.

The customer of choice benefit

As mentioned, our research has shown that good SRM drives on average between 4 to 6% per annum benefit, so for ease of comparison let’s say 5%. For Jackson Steinem & Co., this equates to an annual saving of 5% of £1.2m, or £60,000.

Compare the £417 saving from extending payment terms to the £60,000 that Jackson Steinem & Co. could have saved through implementing SRM with their supplier. It’s clear to see which is more beneficial financially for Jackson Steinem & Co., not to mention the customer of choice benefits that they would attract by being better to work with.

So delaying suppliers’ payments doesn’t pay, but implementing SRM does. For more information about SRM or SRM research, please go to www.stateofflux.co.uk.

Author:

Alan Day is the founder and chairman of State of Flux, a global procurement consultancy and SRM software company.

He can be reached at enquiries@stateofflux.co.uk or +44 207 8420600.

[1] A ‘customer of choice’ is a company that, through its practices and behaviours, consistently positions itself to receive preferential access to resources, ideas and innovations from its key suppliers that give it a competitive advantage.

[2] Frederick Herzberg 'The Motivation to Work'

All industry insights in one E-Book

Download the SRM Research Report 2022 and get access to data points from over 300 companies (anonymously), 9 Case Studies and many more articles.

At State of Flux, we believe that the route to enhanced business performance is how organisations engage and support their suppliers. We specialise in designing bespoke Supplier Management programmes that assess existing supplier value while also identifying and unlocking collaborative routes to add value for both customer and supplier organisations.

.png?width=268&height=307&name=Report22%20mock%20up-720x827-transparent%20(2).png)