Are you a polar bear, like the majority?

One of the key findings from the 2022 State of Flux Global SRM Report focuses on just how much work we, as a Supply Chain community have to do when it comes to the human side of our supplier relationships. Our research showed that just over 20% of businesses have a high level of maturity when it comes to the human elements of good supplier relationships. This seems counterintuitive, considering that ‘relationships’ are focused on the interactions between humans.

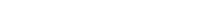

State of Flux’s research centres on six pillars which support strong supplier relationships. These are Value, Engagement, Governance, People, Technology and Collaboration. Engagement, People and Collaboration are the pillars which support the ‘Human’ side of our supplier relationships. Value, Governance and Technology support the ‘Process’. Process-focused supplier relationships almost double human-focused supplier relationships with slightly more than 40% of organisations reporting high process maturity.

These findings give us cause to reflect on where our individual organisations sit within this Human/Process matrix, how we structure our organisations and what changes we need to make in order to progress towards maximizing the value of our supplier relationships.

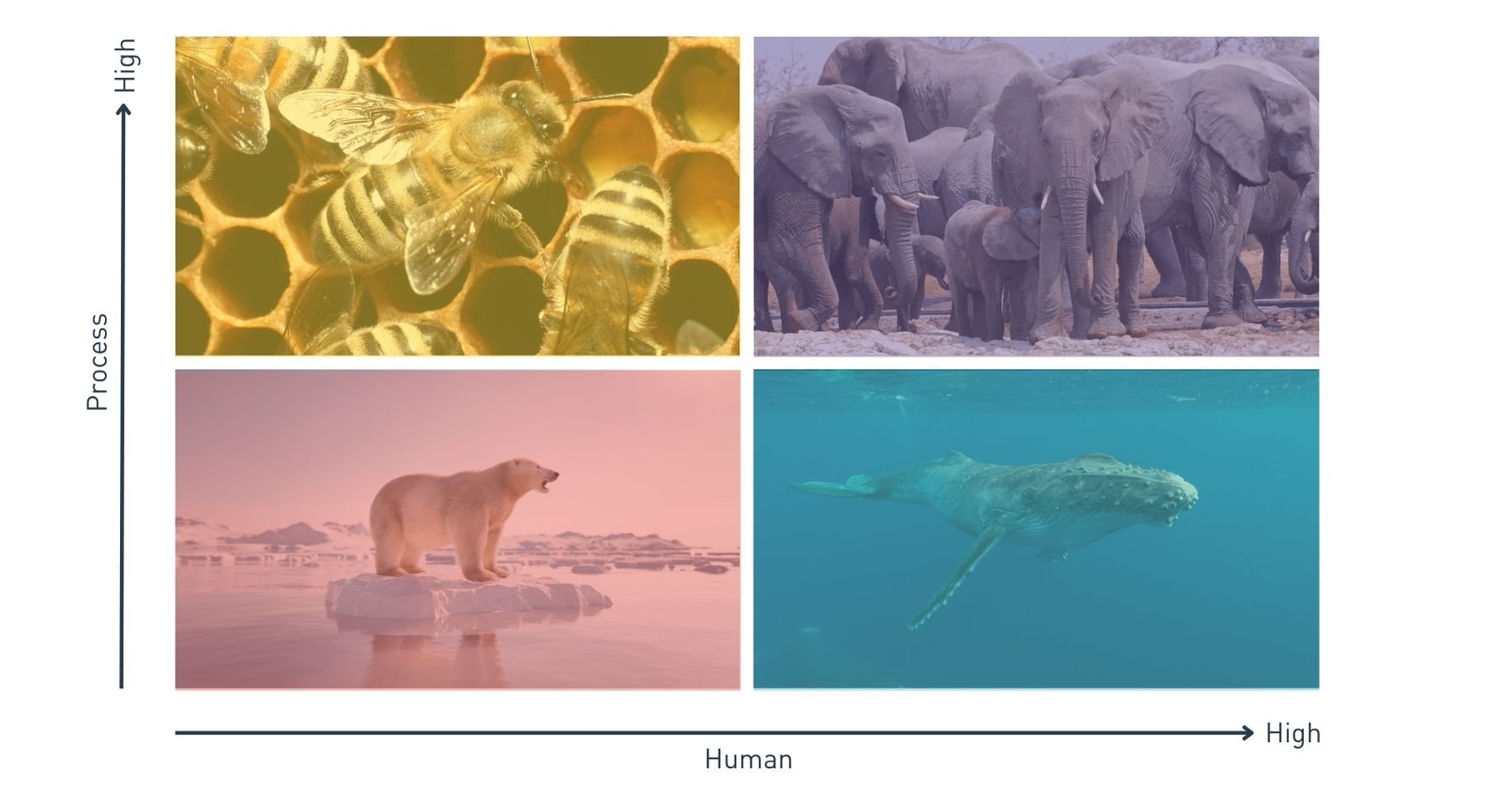

Polar Bears (Independent) – 54% (of global respondents)

These organisations represent the largest portion of global organisations when it comes to Supplier Relationship maturity. SRM continues to be a developing concept within these organisations and is often characterized by no specific supplier relationship roles and can lead to inconsistent communication, unreliable deliveries, and inadequate supplier selection. Like a Polar Bear, these organisations have fewer long-term partnerships and tend to be reactive and less able to adapt to changing environments

Bees (Systematic) – 23%

Traditionally, Procurement and Supply Chain have been a source of cost reductions rather than business growth and investment. These organisations tend to focus supplier relationships towards standardisation and lowest per unit costs rather than collaborating with suppliers to foster innovation. Like a Bee, these organisations have adapted their processes and policies to navigate a complex internal structure and adapt to environmental changes. However, they are yet to develop strong partnership bonds.

Whales (Cooperative) – 3%

The most elusive of organisations, businesses with high human and low process focus represent only 3% of global respondents. These organisations are often maturing as a business and consolidating after periods of growth. Their supplier relationships are typified by ‘hand-shake’ agreements with key supply partners but may lack the necessary rigour to continue as organisations and their reliance on their key suppliers expand. Like the Whale, these organisations have developed strong bonds with those closest to them. However, their ability to adapt to changing environments is limited by an absence of formalised processes.

Elephants (Cohesive) – 19%

Approximately one in five organisations have the desired combination of high human and process maturity. These organisations are able to strike the balance between standardised processes and collaborative relationships with suppliers. This leads to improved supplier performance, innovation and tangible value returns. These organisations regularly achieve more than 4% cost benefit over and above contract value from their supplier relationships. The Elephant navigates a complex social hierarchy with well-understood roles and responsibilities throughout its family group. In doing so, the Elephant is also able to establish efficient group problem-solving skills which allow it to adapt to changing environments.

The proportion of 4 Organisational Types

In order to move our organisations forward, we need to work on ways to best utilize our people and our relationships. Our research suggests that in 2022 however, this sentiment regressed. Compared to 2021 results, Collaboration globally fell by 14%. This comes from organisations looking inwardly to adjust to Covid-impacted supply chains rather than engaging with key suppliers to develop shared initiatives and win-win outcomes.

In 2023 we have an opportunity to recalibrate the way we engage with our supply chain partners. Much has changed and we are now experiencing constant change and supply chain volatility. Working on how we can become better partners and better friends with our suppliers is a strategy that can provide us with the necessary support and empathy from an integrated network of suppliers. This could prove to be the difference in how we navigate the complexities of the emerging global business landscape… together.

All industry insights in one E-Book

Download the SRM Research Report 2022 and get access to data points from over 300 companies (anonymously), 9 Case Studies and many more articles.

At State of Flux, we believe that the route to enhanced business performance is how organisations engage and support their suppliers. We specialise in designing bespoke Supplier Management programmes that assess existing supplier value while also identifying and unlocking collaborative routes to add value for both customer and supplier organisations.

.png?width=268&height=307&name=Report22%20mock%20up-720x827-transparent%20(2).png)